The world of cryptocurrency has been buzzing with excitement lately, thanks to the impressive rally of Bitcoin in the first five weeks of 2023. As 2023 began, the price of Bitcoin has once again captured the attention of investors, traders, and casual observers alike. This comes after the downtrend followed by cryptocurrencies in 2022. However, not everyone is convinced that this is a sustainable trend. In fact, many experts are warning that the current rally may be a “bull trap.” They warn investors to be cautious about jumping in too soon and not getting out at the right time.

Despite these concerns, the interest in Bitcoin and its future price remains high. With its decentralized nature, finite supply, and growing adoption, many see Bitcoin as a hedge against the current, ever-growing inflation rates. Bitcoin also presents a potentially lucrative investment opportunity, in this case. But how much will Bitcoin be worth in the coming years? Will it continue to soar in value, or will it come crashing down? These are the questions that many are eager to answer, and in this article, we aim to do just that.

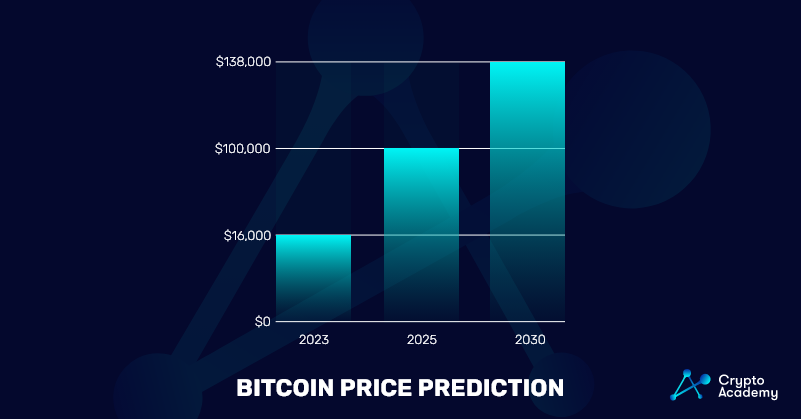

Bitcoin Price Prediction 2023, 2025, 2030

Bitcoin Price Prediction 2023

In the current state of Bitcoin’s market performance, there is a mixture of excitement and caution as the cryptocurrency has rallied in the first five weeks of 2023, but many experts warn of a possible bull trap. To accurately predict the price of Bitcoin in 2023, it’s important to consider various factors such as economic and geopolitical forces, technological advancements, and adoption trends within the crypto industry, as well as historical price patterns and market sentiment. By analyzing these factors, we get a clearer picture of what the future may hold for the price of Bitcoin in 2023.

When we look at the previous bull run, we can see that Bitcoin’s recent performance was expected. Usually, Bitcoin, followed by the whole crypto market, gets volatile in the first and second months of the year. As we are in February right now, we can see that Bitcoin is performing well and its price is up greatly from Jan. 01. While this rally lasted several weeks, most experts believe that it has finally come to an end. According to charts from previous years as well as technical analyses, we see that Bitcoin could experience a drop in price in the upcoming months. This trend could continue throughout the summer, with the price of Bitcoin potentially going back to $13,000.

After hours of research, we concluded that Bitcoin is likely to end the year with a potential price range between $14,500 – $16,000. While this may seem bearish for most people, we must understand the current circumstances of the global economy. While the stock market and the foreign exchange markets are struggling, the crypto industry might find it harder to recover.

Bitcoin Price Prediction 2025

The trading value of Bitcoin was and will probably continue to be volatile. While Bitcoin did not perform as well in the previous 15 months, this does not mean that it won’t do so in the future. Since its debut, Bitcoin has undergone cycles of bull and bear markets. The cycles often look like this:

- Bull Market (12 – 14 months)

- Bear Market (12 – 14 months)

- Recovery Phase (24 – 28 months)

The previous bull market started in late 2020 (after the Bitcoin halving event) and ended in late 2021 after Bitcoin reached its peak at ~$69,000. The bear market allegedly started at the start of 2022, continued throughout the year, and ended just recently. If this information is correct, the market is currently in the recovery phase. By the end of 2024 and the start of 2025, however, we expect that the market will begin a new bull cycle. So, we see Bitcoin trading somewhere between $19,000 – $26,000 at the beginning of 2025. As the year goes by, we believe that Bitcoin could hit a new all-time high. By the end of 2025, Bitcoin is likely to have set a new all-time high way above the current $100,000 milestone.

Bitcoin Price Prediction 2030

By the year 2030, Bitcoin is likely to have gained mass adoption. Even this year, the adoption rate of Bitcoin has been surging, with countries and corporations throughout the world working towards implementing Bitcoin, blockchain, and crypto in their current systems and services. While adoption doesn’t necessarily mean an increase in price, we know that the more people use Bitcoin, the more liquid it becomes. This usually has a positive effect on the price of the currency.

The market could be bearish in 2030. Even though the market is likely to be bearish, Bitcoin could be sitting above the price of $150,000. This is because by 2028 – 2029, Bitcoin might’ve set new all-time highs, some potentially above $200,000. To wrap it up, our Bitcoin price forecast shows Bitcoin trading at a price between $125,000 – $175,000. As the currency’s inflation rate keeps halving, the demand is likely to go up. This often has a positive effect on the market performance of Bitcoin.

What Will Bitcoin Be Worth in 2024?

Satoshi Nakamoto, the creator of Bitcoin, implemented a mechanism to keep the inflation rate of Bitcoin intact. This mechanism is known as the Bitcoin halving mechanism. Every four years, the Bitcoin production rate gets halved. In general, if the demand for Bitcoin remains the same or increases, while the supply is reduced, the price of Bitcoin may increase. This is because a reduced supply of Bitcoin means that it becomes relatively scarcer. This can increase its perceived value and drive up the price.

As per usual, Bitcoin is likely to rally by the end of 2024. While it might not hit a new all-time high, Bitcoin’s price could go well above $42,000. This will increase the hype in the market and incentivize investors to come back to the crypto industry. Thus, we believe that this potential rally could pave the way for this asset to continue increasing in price in the next year, 2025.

Will Bitcoin Go Up Again?

According to many experts and crypto enthusiasts, Bitcoin is not dead – obviously. While the market has been underperforming in the last year and a half, it is far from dead. In the last 30 days, the average daily trading volume of Bitcoin was $30 million. For your information, the biggest stablecoin, USD Tether (USDT), has an average trading volume of $40 million. This is an indicator that the industry is still as active as ever.

The current state of the crypto industry does not determine its longevity. MM Crypto, a major cryptocurrency Youtuber, believes that the worst is yet to come for Bitcoin and that it could hit new lows this year. However, he believes that the cryptocurrency market could recover by mid-2024 and a new bull run will commence.

Takeaways

- The interest in Bitcoin remains high, and it’s considered a hedge against the ever-growing inflation rates.

- Bitcoin price prediction for 2023 is between $14,500 – $16,000.

- Bitcoin’s performance in the first few months of the year is usually volatile.

- Experts predict a bearish market for Bitcoin in 2023.

- Bitcoin is likely to end the year with a potential price range between $14,500 – $16,000.

- The market could be bearish in 2030, but Bitcoin may be worth over $150,000.

- By 2025, the market is likely to begin a new bull cycle, and Bitcoin is predicted to hit a new all-time high.

- By 2025, Bitcoin is expected to trade between $19,000 – $26,000 at the beginning of the year.

- The Bitcoin halving mechanism may increase its price as supply becomes relatively scarcer.

- Bitcoin’s price prediction is affected by various factors such as economic and geopolitical forces, technological advancements, and adoption trends within the crypto industry, as well as historical price patterns and market sentiment.