Bitcoin Gold was established in order to create a user-friendly Bitcoin alternative in 2017. This Bitcoin Gold price prediction takes you through the project details, the scope of the cryptocurrency and the price movement details in 2022 and beyond.

The Bitcoin Gold network intends to bring together the robustness, security, and features of the Bitcoin blockchain with the chance for experimentation and development. With a blockchain that is quite similar to Bitcoin but without utilizing Bitcoin resources like hash power or competing for the “true Bitcoin” moniker, BTG expands and improves the crypto ecosystem. The startup wants to offer a coin that can be implemented in a way similarl to Bitcoin while also giving DeFi and dApp developers more options to use the token.

A community-led initiative called Bitcoin Gold aims to hard fork Bitcoin in an experimental manner to a different proof-of-work algorithm. The goal of this is to restore decentralization in Bitcoin mining. It is a reality that a very small number of companies have taken over the production and distribution of mining equipment. Some of them have engaged in abusive practices against individual miners, and the Bitcoin network as a whole has replaced Satoshi Nakamoto’s idealistic vision of “one CPU, one vote.”

With the help of widely-available consumer hardware that is produced and sold by well-known mainstream companies, Bitcoin Gold will give countless people the chance to take part in the mining process. A more resilient, democratic, and decentralized mining infrastructure is more in accordance with Satoshi’s original concept. If the community views the Bitcoin Gold experiment positively, it might contribute to the development of consensus for a proof-of-work hard fork, one day, on the original Bitcoin.

The hard fork of Bitcoin to switch the proof-of-work algorithm from the SHA256 method initially chosen by Satoshi Nakamoto to Equihash was announced by Jack Liao, CEO of LightingAsic and BitExchange, in July 2017. These modifications enabled a completely new class of people and organizations to take part in mining this new branch of the Bitcoin blockchain without purchasing specialized equipment. The Bitcoin Gold project has swiftly expanded since it was unveiled, drawing enthusiasts, miners, and developers from all over the world.

A group of enthusiasts from various backgrounds and skill sets established Bitcoin Gold. The lead developer and co-founder of Bitcoin Gold are Hang Yin. Hang Yin chose to create Bitcoin Gold after spending three years working for the IT giant. The second co-founder of Bitcoin Gold and a member of its board of directors are Martin Kuvandzhiev.

Although Bitcoin Gold is a hard fork of Bitcoin that uses the proof-of-work (PoW) consensus algorithm, one of BTG’s key objectives was to revolutionize mining by introducing the Equihash PoW, which, in contrast to the Bitcoin network, promotes GPU mining. Thie version of Equihash utilizes more RAM than an ASIC can provide functions yet just fine on many graphics cards.

Bitcoin Gold (BTG) Fundamental Analysis

The original Bitcoin blockchain’s inherent qualities are combined in a special way with a cutting-edge method of creating and using blockchain apps to create Bitcoin Gold. Since Bitcoin Gold is an open-source protocol, developers are free to participate in the blockchain’s management and advancement. The company claims that this is a prerequisite for advancing decentralization and one of the main areas where Bitcoin fails.

One of the first cryptocurrency hard forks, Bitcoin Gold, has caught the interest of institutional and business investors. BTG is accessible through a large number of exchanges, wallets, and swap services. A number of internet browsers and service companies have actively embraced Bitcoin Gold. A hard fork through some members of the Bitcoin community was because of too much centralization in BTC.

The entry of huge corporations equipped with potent machines specifically geared towards mining into the mining sector. This was another issue noticed by the creators of Bitcoin Gold. They started the initiative to defend Bitcoin’s initial emphasis on decentralization and establishing true peer-to-peer money as a result of all of this.

In response, the Bitcoin Gold project introduced a network that aims to provide a more “democratic” method of mining. Mining the BTG coins has been made possible with standard or even basic gear (such as GPUs), so it no longer favors huge market players with high-end equipment (graphics processing units).

The team is working on its BTGPay solution, which will assist users in locating the best BTG-based debit card services for their needs and areas. It will also act as a marketplace of retailers where customers can spend their BTG and where vendors can advertise that they accept it. To assist retailers in accepting Bitcoin Gold, it also functions as a network of partners (solution providers, payment services, and eCommerce integrators).

How does Bitcoin Gold Work?

Bitcoin Gold forked from Bitcoin in the same way Bitcoin Cash did, by enforcing new consensus rules starting at a predetermined BTC block height. Bitcoin Gold has modified different consensus rules than Bitcoin Cash did, but it did so in a similar way. At block 491407, the new regulations were now in operation.

Following that, Bitcoin Gold miners started constructing a separate branch of the Bitcoin network. If you have Bitcoin, you will instantly receive an equivalent amount of BTG. This new branch has the same ownership distribution and transaction history as Bitcoin at the fork block.

When creating the first PoW system for Bitcoin, Satoshi Nakamoto decided to employ the SHA256 algorithm. Bitcoin Gold will replace SHA256 with the new proof-of-work algorithm, Equihash, in order to combat this concentration of power in the mining industry. Equihash is a memory-hard algorithm that can be solved most effectively by GPUs.

It is a common form of hardware found in computers and smartphones. It is manufactured by well-known firms and accessible globally. A completely new class of investors and entrepreneurs will have the chance to get involved in mining, courtesy of Bitcoin Gold.

The mining of Bitcoin Gold will once more be distributed, according to Satoshi’s original intent. ASIC resistance is a characteristic that Bitcoin Gold will always have. In the event that Equihash ASICs ever become widespread and mining once more becomes centralized, Bitcoin Gold will undergo another hard fork in order to deploy a new PoW algorithm.

DigiShield V3 is the difficulty adjustment algorithm used by Bitcoin Gold. The objective is to change the difficulty per block to aim for a ten-minute block interval by measuring the amount of time that has passed between the most recent block and the median of a predetermined number of prior blocks. This more responsive approach for difficulty adjustment is very helpful in preventing significant fluctuations in the total quantity of hash power.

A technique called SIGHASH FORK ID replay protection is used in Bitcoin Gold to implement a novel approach to generate a transaction’s hash such that any new Bitcoin transactions would be invalid in the Bitcoin Gold blockchain and vice versa. As a result, it is an efficient two-way replay protection system. Replay protection was enabled in Bitcoin Gold prior to the launch.

A distinctive address format will be used to make sure that Bitcoin Gold does not contain any potential for confusion. The prefix of PUBKEY ADDRESS and SCRIPT ADDRESS will be changed to a new prefix that can be clearly recognized from Bitcoin addresses (the prefix is still to be decided).

Bitcoin Gold Tokenomics

The first blocks after the fork will have a lower difficulty level to support the ongoing and future development of Bitcoin Gold, allowing the development team to mine these blocks quickly. After that, the new difficulty adjustment algorithm will go into effect, giving everyone the chance to mine on an equal footing.

As a result, the development team for Bitcoin Gold will be in charge of 0.476 percent of the total coin supply. This will serve as the primary funding source for all future work on the project, including important research and testing that could someday contribute to reaching a consensus for a proof-of-work change on Bitcoin.

The initial BTG mined by the Bitcoin Gold (0.476%) development team will be held in multi-signature wallets. Forty percent of the Bitcoin Gold would be distributed for BTG Startup expenses, such that twenty percent tokens would be for yearly expenses. Five percent would be allocated to prefork costs and initial reward for the core team.

Bounties and app collaboration would get seven percent tokens, while three percent tokens would be dedicated to community development. Sixty percent of the funds will be time-locked and released in proportional amounts of twenty percent over the course of three years each to cover the development costs. These 60% BITCOIN GOLD funds would be divided into thirty percent development funds and fifteen percent for ecosystem and community development each.

Bitcoin Gold Future Plans

Future development would lead to upgrades to the core protocol, lightning network, and decentralized exchange. Positive changes can come in addresses of Bech32, sidechains, and Cross-chain atomic swaps. Operational and infrastructure costs would be spent on the website, server for more than twelve full nodes in six continents, and more than five DNS seeds.

Additionally, costs will be spent on administering the system, domain fees, and security and penetration testing by a third party. Costs spent on communication in the future would develop their design assets and social media with meetups, press releases, and developer conferences.

Social actions in the future would be related to development in the economy, blockchain education, and GPU Mining infrastructure. Funds for economic development would be spent on the BTG debit card program in Latin America and decentralized fiat-crypto brokerage network globally. Funds for blockchain education would be invested in the content creators and influencers having an effective contribution to the rise of Bitcoin awareness and adoption.

On the other hand, funds for the GPU Mining Infrastructure would be dedicated to small or mid-scale loans for individuals and businesses to operate GPU mining hardware. User-friendly mining applications for bringing mining to a multilingual and non-technical audience using developer bounties.

Bitcoin Gold (BTG) Price Analysis

The Bitcoin Gold price was $23.59 on July 23, 2022, with a trading volume of $227.6 million. The CoinMarketCap currently ranks it as number 85, with a market cap of $413 million. It has a circulating supply of more than 17.5 million BTG coins and a maximum supply of 21 million BTG coins. It can have excellent growth in prices in the long term.

Rank: 130

Bitcoin Gold Price Prediction – Crypto Academy

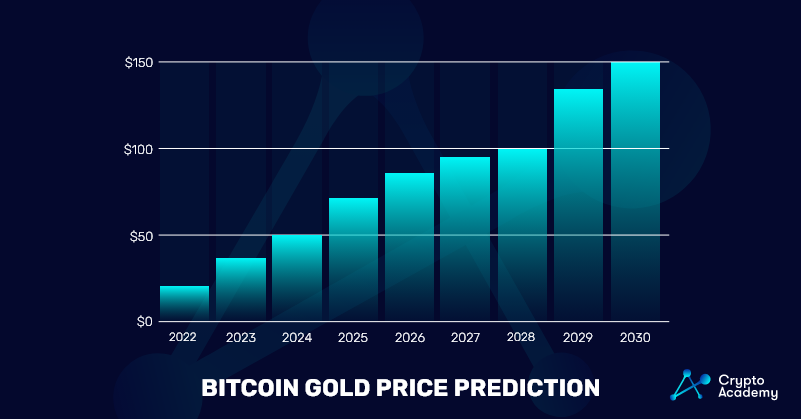

Here are the price predictions for Bitcoin Gold for upcoming years on the basis of their future plans.

Bitcoin Gold Price Prediction 2022

According to our analysis of the historical data of BTG, In 2022, the price of Bitcoin Gold can reach a minimum level of $20. The BTG price can reach the maximum level of $35 due to it being a user-friendly alternative to Bitcoin, with an average trading price of $27.5.

Bitcoin Gold Price Prediction 2023

The price of Bitcoin Gold is anticipated to reach a minimum level of $25 in 2023. The Bitcoin Gold price may hit the maximum level of $43 because of a combination of the security and sturdiness of the Bitcoin blockchain, with the average price of $32 throughout 2023.

Bitcoin Gold Price Prediction 2024

According to our forecast price, In 2024, the price of Bitcoin Gold can reach a minimum level of $30. The BTG price can reach a maximum level of $50 with an average trading price of $40. This is because of its characteristics of providing the opportunity for development and experiments.

Bitcoin Gold Price Prediction 2025

The price of Bitcoin Gold can reach a minimum level of $42 in 2025. The BTG price can change hir a maximum level of $70 as it is upgrading the core protocol, lightning network, and decentralized exchange, while the average price can be $55 throughout 2025.

Bitcoin Gold Price Prediction 2026

We forecast the minimum possible price of Bitcoin Gold can reach the level of $50 in 2026. Our findings for the BTG price indicate the maximum level of $82 in 2026, with an average forecast price of $63. This can happen with advanced addresses of Bech32, sidechains, and Cross-chain atomic swaps.

Bitcoin Gold Price Prediction 2027

On the basis of our deep analysis of the price data of BTG, we forecast the price of Bitcoin Gold to be at the minimum value of $64. The Bitcoin Gold price can reach a maximum level of $90 due to its expenses in operations and infrastructure, such as website, servers, and DNS seeds, with an average trading level of $75.

Bitcoin Gold Price Prediction 2028

We predict the price of Bitcoin Gold to reach a minimum level of $70 in 2028. The Bitcoin Gold price might hit the maximum value of $100 through its security, penetration testing, and administering system, with an average trading price of $85 throughout 2028.

Bitcoin Gold Price Prediction 2029

We forecast for 2029 an average price of $110. The price of Bitcoin Gold can reach a minimum value of $90. The BTG price can reach a maximum price value of $130 by spending on communications and social media through meetups and developer conferences.

Bitcoin Gold Price Prediction 2030

We expect the price of Bitcoin Gold to reach a minimum value of $110 in 2030. The Bitcoin Gold price can be at a maximum value of $150 by development in the economy, awareness of blockchain, and GPU Mining infrastructure. At the same time, the average trading price can be $130 throughout 2030.

Bitcoin Gold Price Prediction – Market Overview

Following are the price predictions given by famous crypto-related websites for the future of Bitcoin Gold.

Priceprediction.net

PricePrediction.net expects the BTG price to reach a maximum level of $25.52 at the end of 2022. The average price of Bitcoin Gold (BTG) might go to $23.29 by the end of this year. If we estimate the five-year plan, it is estimated that the coin will easily reach the $112.17 mark. Bitcoin Gold can hit the highest price of $930.74 by 2030.

Digital Coin Price

According to Digital Coin Price, the lowest and highest prices of Bitcoin Gold can be $33.02 and $125.60 in the future. The prices after one, three, and four years can be $37.20, $41.31, and $46.63. The prices can be $62.63, $82.24, and $99.08.

Coin Codex

Based on Coin Codex tech sector growth prediction, the price of BTG price can be between $ 29.35 and $ 50.86, with a price rise of 119.44% in the best conditions of 2024.

The expected BTG price can lie between $ 37.57 and $ 112.83, with a revenue of 386.78% in the favorable conditions of 2025.

The BTG price can be lying between $ 48.10 and $ 250.29 in 2026 if the situations remain positive. This means that the price of your current investment would have increased by 979.82% in the year 2026.

Wallet Investor

Wallet Investor do not consider it a good investment. The maximum prices of BTG at the end of 2022 can be $51.41 and $1.648 at the end of 2023. By the end of 2024, 2025, and 2025, the prices can be $0.638, $0.470, and $0.410. In the next five years, the maximum price can be $0.449.

Tech News Leader

Tech News Leader analysts think Bitcoin Gold can reach the highest price of $34.94 and $104.09 in one and five years. Bitcoin Gold will be worth $104.09 in 5 years. BTG can be worth $687 in 10 years. The price can be between $664.02 and $807.15 in the next eight to ten years.

How to Buy BTG?

You can easily buy Bitcoin Gold (BTG) on Binance at affordable fees with the highest security.

Step 1: Create an Account.

You can buy the crypto you want on a Binance account. You have to login/register on the Binance app or website using your email or mobile number. To buy Bitcoin Gold (BTG), you will also need to verify your identification.

Step 2: Select a Payment Method.

After getting an account, you have to select a payment method to buy the Bitcoin Gold (BTG) asset. Then you have to click on the “Buy Crypto” link on the Binance website navigation. The options available for your country will show up. You can prefer a stablecoin, such as USDT or BUSD, to buy BTC with better coin compatibility.

The easier options available for new users to purchase Bitcoin Gold can be both bank deposits or Visa and MasterCard. You can also buy Bitcoin Gold directly from another user with the peer-to-peer service of Binance or use one of the multiple options of third-party payment channels.

Step 3: Buy BTG

You have one minute to place your order at the concurrent price. After each minute, the order gets recalculated on the basis of that live market price. You can click the ‘Refresh’ button to see the new amount of orders. Finally, confirm your order and then store your BTG in your account or your personal crypto wallet. You can also stake them or trade them for another crypto on Binance Earn.

Frequently Asked Questions (FAQs)

Is BTG a Good Investment?

Yes, BTG is a good investment due to the power of its bounty’s incentives.

Can BTG Reach $100?

BTG can reach $100 by 2028 through advanced security, penetration testing, and administration system.

Where to Buy BTG?

You can buy currently on Binance, OKX, Bybit, Huobi Global, and Gate.io.

Takeaways

- Bitcoin Gold was established in order to create a user-friendly Bitcoin alternative in 2017.

- The BTG network intends to bring together the robustness, security, and features of the Bitcoin blockchain with the chance for experimentation and development.

- The startup wants to offer a coin that can be implemented similarly to Bitcoin while also giving DeFi and DApp developers more options to use the token.

- A community-led initiative called Bitcoin Gold aims to hard fork Bitcoin in an experimental manner to a different proof-of-work algorithm.

- Bitcoin Gold will replace SHA256 with the new proof-of-work algorithm, Equihash, in order to combat this concentration of power in the mining industry.

- BTG is a good investment due to the power of its bounty’s incentives.

- The BTG price can reach the maximum level of $35

- The Bitcoin Gold price may hit the maximum level of $43 in 2023.

- The Bitcoin Gold price can reach a maximum level of $90 in 2027.

- BTG can reach $100 by 2028 through advanced security, penetration testing, and administration system.

- You can buy currently on Binance, OKX, Bybit, Huobi Global, and Gate.io.