On November 14, Twitter Spaces chat with the Binance community, Changpeng Zhao gave his thoughts on the FTX fall.

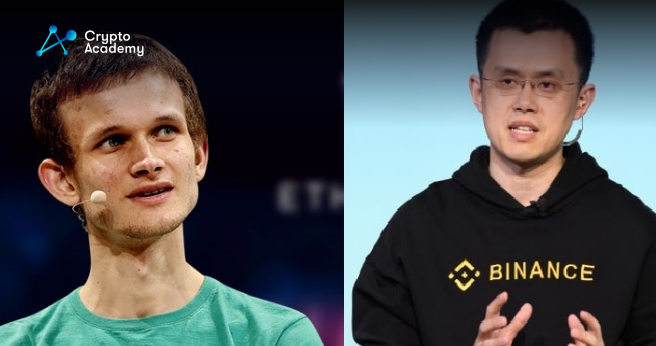

Changpeng Zhao, the CEO of Binance, has made additional remarks regarding the company’s quick collapse days following sending a twitter rant that sparked a run on the banks on the fallen FTX market.

CZ participated in a Monday Twitter Spaces conversation about the shocking bankruptcy of FTX. When it was discovered that FTX was bankrupt, the company filed for Chapter 11 bankruptcy on November 11.

After the implosion of Terra, it was revealed that former CEO Sam Bankman-Fried had covertly shifted $10 billion in client assets to rescue out his trading operation Alameda Research. Binance had shown an interest in purchasing the exchange but withdrew for due diligence reasons.

CZ underlined the necessity for greater industry transparency in his response to the issue. He noted that “anything we can do to increase transparency is good.”

After the demise of FTX, Binance published a blog post detailing its cryptocurrency holdings. The largest exchange in the industry has also made preparations to show evidence of the money listed on its financial statements. Zhao announced at the Spaces session that Vitalik Buterin, the man behind Ethereum (ETH), had committed to develop a proof-of-reserves protocol using Binance.

We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete. 2/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

We typically hold tokens for the long term. And we have held on to this token for this long. We stay transparent with our actions. 4/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

CZ assured attendees that Binance adopts a more conservative view to its operations by mentioning a few of FTX and Alameda’s dubious activities before the catastrophe of the week before. He declared they are not accepting VC investments or loans from other individuals.

The news inspired a positive outlook for the market in light of the recent turmoil, as influencers took to Twitter to inform the community:

@cz_binance Says Vitalik Buterin will Build Proof-of-Reserves Protocol. https://t.co/KtVVYSISHF

— Granit Academy (We're hiring) (@granitacademy) November 14, 2022

He declared, “We are not taking loans from other people, we are not taking VC investments.” All cryptocurrency exchanges, he said, are inherently pretty dangerous companies.

CZ took advantage of the occasion to issue a warning about potential cascade effects. “If [a company’s] assets do not include a large percentage of stablecoins, that is a risky sign,” he stated. Zhao’s message comes after worries that Crypto.com might be insolvent; some have cited the exchange’s absence of stablecoins in this regard. Kris Marszalek, the company’s CEO, denied the reports during an ask me anything session held today.

The FTX crisis, which began officially with CZ’s announcement that Binance will liquidate its FTT holdings, continues to be processed by the cryptocurrency community. The narrative just underwent a strange attack on the troubled exchange in the last couple of days, during which more than $400 million in cryptocurrency was transferred to outside accounts.

Clients remain unable to reach their funds as fresh rumors and hypotheses about how Bankman-Fried managed his empire continue to spread in the cryptocurrency community.