Aave (AAVE) has been on a bearish run throughout the year, with the price decreasing by around 85% in the first two quarters. The price of AAVE went as low as $45 in June, which was the lowest in almost 9 months. Nonetheless, after finding support in that area, AAVE started to increase. During the summer months of this year, AAVE increased by around 160%, indicating a reversal in the long-term trend. Still, the price encountered resistance at around $115, and it has been on the decline ever since that.

Recently, the price of AAVE has been on the rise. In the last few days alone, AAVE has increased by around 30%, making it one of the best performers of the week. This increase shows that AAVE has penetrated the upper trendline of the descending wedge, indicating that the trend could reverse in the coming weeks.

But before making predictions on how AAVE may perform in the short run, we must look through technical and fundamental factors that may affect the price of AAVE.

Aave (AAVE) Technical Analysis

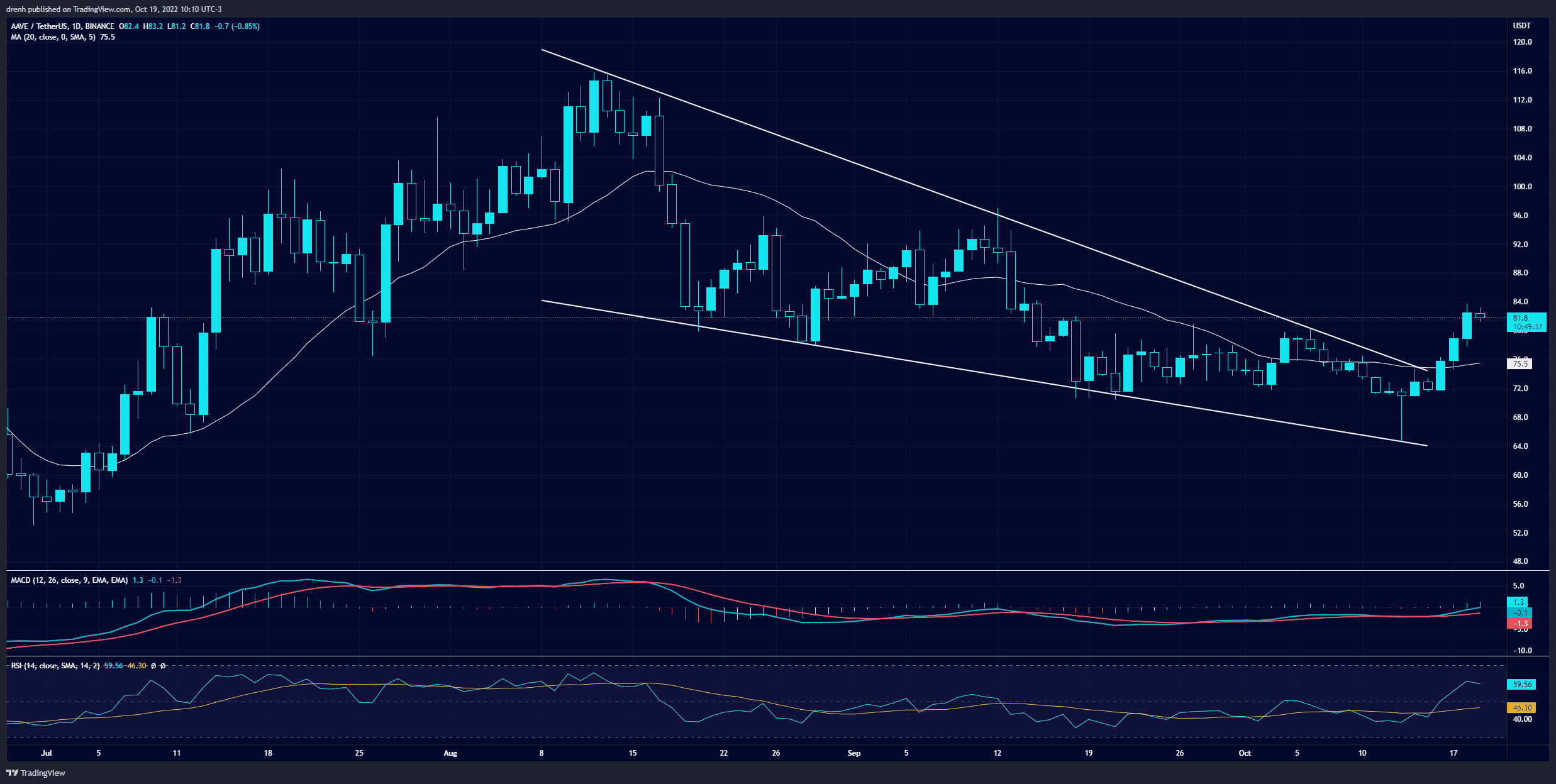

As can be seen in the AAVE/USDT 1-day chart, the price of AAVE had a breakout of 30%, which hinted at a potential bullish reversal in the chart. While the long-term chart still remains bearish for AAVE, the recent price movement has significantly improved the market sentiment.

AAVE traders were quick enough to withdraw funds due to the recent increase since the selling pressure has slightly increased. This created a resistance structure at $84. Currently, AAVE is on the verge of retracement, other things equal.

Fibonacci retracement levels of the recent price movement suggest that the price of AAVE could have strong support at 23.6% and 61.8% levels, respectively.

Indicators

The fear and greed index of the 1-day chart suggests that AAVE traders suggest that the index has slightly improved. There is still extreme fear in the market, however, given the current state of BTC and other altcoins.

The RSI of a 1-day chart suggests that it has significantly improved recently. It is above 50, meaning that the buying pressure is relatively high and that there is space for growth for AAVE in the coming days.

The MACD line of a 1-day chart is above the signal line and the baseline due to the recent increase in the price. The current momentum is bullish for AAVE, but the lines may soon converge if a retracement occurs.

The 20-Day MA is below the current price of AAVE, meaning that the trend is now bullish, other things equal. The same applies to the 9-Day EMA, which could also act as a natural support to the price of AAVE if the latter retraces.

Aave (AAVE) Fundamental Analysis

Recently, Justin Sun, the founder of Tron, reportedly withdrew around $50 million worth of USDT from the Aave ecosystem and transferred them to a Poloniex-funded address. Because of that, the total supply of USDT in the AAVE/USDT pool has declined to around $250 million, which could be alarming to AAVE whales.

#PeckShieldAlert The $USDT in the Aave Pool has dropped from $300M to $250M, -17% pic.twitter.com/oPe7DLBqVI

— PeckShieldAlert (@PeckShieldAlert) October 17, 2022

To give a little more context on this, Justin Sun was banned by the Aave ecosystem after someone reportedly sent 0.1 ETH to his address from a suspicious wallet from Tornado Mixer.

I’m officially blocked by @AaveAave since someone sent 0.1 eth randomly from @TornadoCash to me. @StaniKulechov pic.twitter.com/tNXNLNYZha

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) August 13, 2022

Many expected that this could have a negative impact on the price of AAVE since someone such as Sun is highly influential. To support this, Huobi Token has grown massively recently after it was announced that Sun is officially involved with the project.

However, the price has instead increased recently. Therefore, this suggests that AAVE is simply not that affected by “big game” influencers.

In other news, Aave is launching its own stablecoin known as GHO. GHO aims to solve the stablecoin trilemma of capital efficiency, price stability (collateralization), and decentralization.

For more details, check out the new updates on the development of GHO:

The Aave Companies have provided an update on the development of GHO. This includes the GHO technical paper and details on the first GHO audit. Read more here 👉 https://t.co/VqQvIBG5pH

— Aave (@AaveAave) October 14, 2022

AAVE Price Prediction

Based on this price analysis on Aave (AAVE), the price of AAVE could increase in the coming days due to the recent price breakout. We could expect the price of AAVE to aim for $125 in the coming weeks, other things equal.

Takeaways

- Aave (AAVE) has increased by 30% in the last few days.

- Recent AAVE price breakout hints at a possible bullish momentum for the coming weeks.

- Justin Sun reportedly withdrew $50 million from the AAVE blockchain.

- Aave is launching its highly anticipated stablecoin, $GHO.

- AAVE could aim for $125 in the coming weeks.